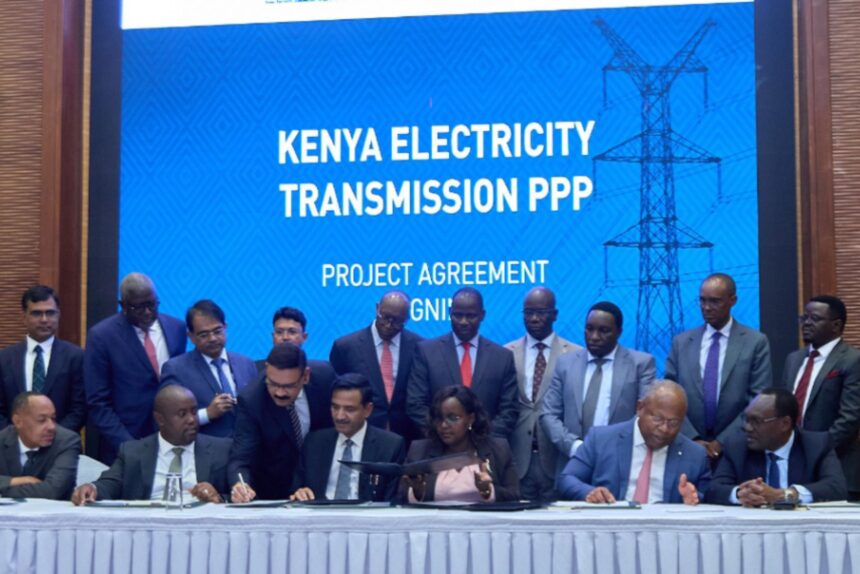

Kenya has unveiled one of its most ambitious reforms yet in the way it builds and finances critical energy infrastructure, signing a $311 million public-private partnership (PPP) to expand its national electricity transmission network without drawing on public funds.

Under the agreement, the Kenya Electricity Transmission Company Limited (KETRACO) has partnered with Africa50 and Power Grid Corporation of India to finance, construct and operate two major high-voltage transmission lines that are critical to grid stability and renewable energy integration.

The deal marks a significant departure from Kenya’s traditional, state-funded approach to grid expansion and positions the country as a testing ground for privately financed transmission projects in Africa.

“This partnership between KETRACO and Africa50-PowerGrid consortium demonstrates the strength of Kenya’s investment environment and the confidence of global partners in our energy agenda,” Energy Cabinet Secretary Opiyo Wandayi said.

A shift in how Kenya funds its power grid

At the heart of the transaction is a model in which the private consortium shoulders the full upfront cost of the project, estimated at $311 million (about KES 40.4 billion).

KETRACO will make payments only after the infrastructure has been completed, independently verified and is performing to agreed standards.

A special purpose vehicle will be established to design, build, finance, operate and maintain the transmission lines under a 30-year concession. At the end of that period, ownership of the assets will revert to KETRACO in a contractually defined, well-maintained condition.

Wandayi said the agreement demonstrated Kenya’s ability to attract long-term global capital into strategically important sectors.

“We are not only accelerating access to reliable and affordable electricity, but also laying the foundation for industrialisation, job creation, and inclusive economic growth. This is how we turn policy into progress,” Wandayi noted.

What this means

The project centres on two transmission corridors designed to address long-standing weaknesses in Kenya’s grid and unlock new sources of clean energy.

The first is a 400kV double-circuit transmission line stretching approximately 180 kilometres between Lessos and Loosuk. The line will traverse parts of Nandi, Elgeyo Marakwet, Baringo and Samburu counties, with new substations built along the route.

Crucially, it will evacuate wind power from Lake Turkana and support future geothermal generation in the North Rift, regions that have historically struggled to connect large-scale renewable projects to the national grid.

The second corridor is a 220kV double-circuit line running about 72 kilometres from Kibos through Kakamega to Musaga. It represents the first introduction of high-voltage transmission infrastructure into Western Kenya and is expected to strengthen lower-voltage networks serving Kisumu, Vihiga and Kakamega counties.

Together, the two lines aim to reduce outages, cut technical losses and provide sufficient capacity to support industrial and commercial growth in underserved regions.

Protecting public finances amid rising infrastructure needs

For the National Treasury, the financing structure is as significant as the physical infrastructure. Treasury Cabinet Secretary John Mbadi emphasised that the government would not assume construction or financing risk.

“The project’s financing structure reflects prudent fiscal management,” Mbadi said. “The $311 million (KES 40.4 billion) cost will be fully financed by the private partner, safeguarding public resources and allowing the Government to continue investing in priority sectors such as health, education, and agriculture.”

The contract includes performance guarantees, comprehensive insurance cover and strict availability payment conditions. Independent engineers must certify completion and performance before KETRACO begins payments.

Local content requirements are also embedded, ensuring meaningful participation by Kenyan professionals, contractors and suppliers throughout the project lifecycle.

Meeting a $5bn transmission challenge

KETRACO’s Acting Managing Director, Eng. Kipkemoi Kibias, said the PPP was driven by the scale of Kenya’s transmission challenge. The utility plans to add roughly 8,000 kilometres of new transmission lines over the next 20 years, a programme estimated to cost around $5 billion.

“The signing of this Public-Private Partnership agreement with Africa50 and Power Grid Corporation of India reflects our strong commitment to innovative financing solutions in infrastructure delivery,” Kibias said.

Africa50’s Chief Executive Officer, Alain Ebobissé, described the project as an “Africa-first” in power transmission finance, arguing that it could unlock private investment across the continent.

“We commend H.E. President William Ruto and the Government of Kenya (GoK), for the bold initiative that will be the blueprint to further increase private sector investment into the expansion and stabilisation of Africa’s power transmission networks, which are critical to bridging the continent’s electricity access gap.”

Power Grid Corporation of India echoed that view. Its Chairman and Managing Director, Dr R.K. Tyagi, said the company saw Kenya’s project as a replicable model for other African markets seeking to modernise their grids without overburdening public finances.

How it matters for Africa’s energy future

Experts say Kenya’s decision to privately finance and operate critical power transmission infrastructure marks a potential turning point for Africa’s energy sector. Across the continent, weak and underdeveloped transmission networks remain a major constraint, even in countries that have invested heavily in power generation.

By demonstrating that high-voltage transmission can attract long-term private capital under a well-structured, performance-based model, Kenya is offering a practical alternative to debt-heavy, state-funded approaches that many governments can no longer sustain.

The implications extend beyond financing. Transmission is the missing link in Africa’s energy transition, particularly as countries scale up renewable generation from wind, solar and geothermal sources located far from demand centres. Without strong grids, clean power cannot reach industries, cities or households reliably.

Kenya’s project directly addresses this gap by tying renewable-rich regions to the national grid, showing how transmission investment can unlock the full economic and environmental value of existing and future power plants. If successfully delivered, experts say the model could be replicated across Africa, especially in markets facing fiscal pressure and growing electricity demand.

Talking Points

It is notable that Kenya is adopting a public-private partnership model for power transmission, a segment traditionally funded and managed by the state. By shifting financing, construction and operational risk to private partners, the government is signalling a more pragmatic and fiscally disciplined approach to infrastructure delivery.

This deal stands out because KETRACO only pays when the transmission lines are completed and performing to standard. That performance-based structure helps protect public funds while also raising the bar for quality, reliability and long-term maintenance.

At Techparley, we see this as more than a financing arrangement. It reflects a broader maturity in Kenya’s energy sector, where policy ambition is being matched with innovative capital structures that can attract global investors without increasing public debt.

The focus on high-voltage transmission is also critical. Expanding generation without strengthening transmission has long been a bottleneck across Africa. These two lines directly address that gap by linking renewable energy sources in the Rift Valley and North Rift to demand centres and industrial hubs.

There is a strong development angle as well. Bringing high-voltage infrastructure into Western Kenya for the first time could help stabilise power supply for businesses, manufacturers and households that have historically been underserved by the national grid.

However, execution will be key. The success of this model will depend on transparent oversight, strong contract management and KETRACO’s capacity to enforce performance standards over a 30-year concession period.

Looking ahead, this project could become a blueprint for other African countries facing similar funding constraints. If delivered as promised, it strengthens the case for private capital as a viable partner in closing Africa’s power transmission gap and accelerating the transition to cleaner, more reliable energy systems.

——————-

Bookmark Techparley.com for the most insightful technology news from the African continent.

Follow us on Twitter @Techparleynews, on Facebook at Techparley Africa, on LinkedIn at Techparley Africa, or on Instagram at Techparleynews.