Rwandan fintech startup Kayko has secured US$1.2 million in seed funding to deepen its mission of expanding access to finance for small and medium-sized enterprises (SMEs) by transforming everyday business activity into usable financial data.

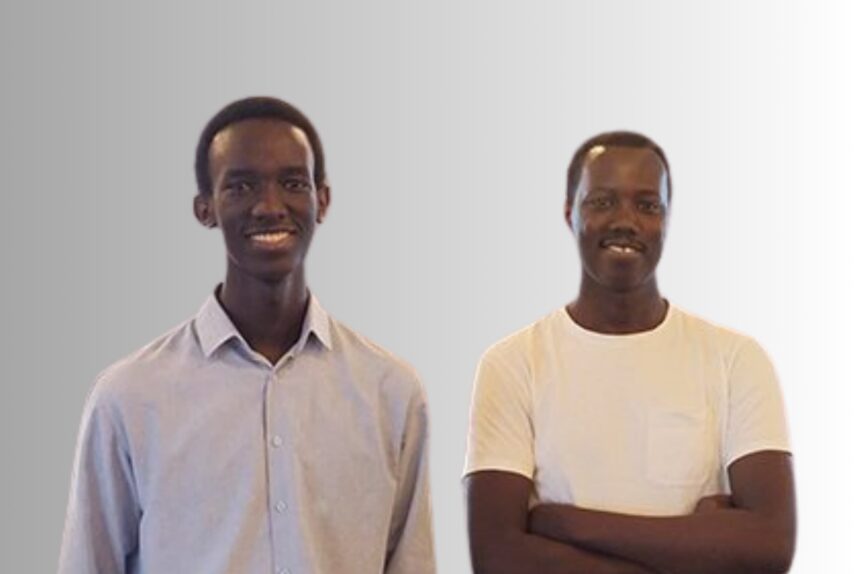

Founded in 2021 by brothers Crepin and Kevin Kayisire, Kayko is addressing a long-standing challenge across Africa’s informal and semi-formal economy, small businesses operate daily, generate revenue, pay taxes, and manage expenses, yet remain largely invisible to banks and financial institutions.

As the founders put it, “millions of SMEs across Africa run their businesses every day, but have no usable financial data to grow, borrow, or scale,” adding that while “cash moves, sales happen, taxes are paid,” banks still cannot “see” these businesses.

The fresh capital, backed by investors including Burrow Capital, Luxembourg Development Agency, and Hanga Ignite by BRD and develoPPP Ventures, positions Kayko to scale its data-driven infrastructure and turn small businesses’ daily operations into real access to credit.

What Kayko Does: Turning Daily Business Activity Into Financial Visibility

At its core, Kayko provides small businesses with a digital operating system that replaces fragmented and informal record-keeping with structured, reliable data.

Through its point-of-sale (PoS) and business management tools, Kayko enables merchants to process sales, track inventory, manage expenses, and handle payments in a single system.

While these functions improve day-to-day efficiency, their deeper value lies in the data they generate.

The founders describe Kayko as a “micro-ERP and data layer for SMEs,” built to capture sales, expenses, inventory movements, and tax compliance signals.

This data, which is often missing or poorly documented among small businesses, can then be used to support credit scoring, working capital solutions, and smarter financial products.

By digitising routine business activities, Kayko effectively creates a financial footprint that lenders can trust, reducing the information gap that has historically locked SMEs out of formal financing.

Solving the SME Financing Gap in Rwanda and Beyond

Access to finance remains one of the most persistent barriers facing SMEs across Africa.

Even profitable businesses struggle to secure loans because banks lack reliable data to assess their performance and risk. Kayko was created specifically to address this disconnect.

According to the founders, the problem is not that small businesses are inactive, but that their financial reality is largely invisible to traditional systems. By structuring business data in real time, Kayko helps bridge this gap between entrepreneurs and financial institutions.

The startup’s approach reframes bookkeeping and compliance not as administrative burdens, but as pathways to growth and credit access.

This model has already gained traction, with more than 8,500 SMEs using Kayko daily for bookkeeping, inventory management, and tax compliance, underscoring the demand for practical, data-driven financial tools at the grassroots level.

Plans for the Newly Raised $1.2 Million

The newly secured seed funding marks a significant milestone for Kayko’s growth strategy. The startup plans to strengthen its technological infrastructure, ensuring that its systems can support a growing user base while maintaining data accuracy and reliability.

Beyond infrastructure, Kayko intends to expand its data-driven lending and credit scoring capabilities, enabling financial institutions to design products that better match the realities of small businesses.

As the founders explained, “This funding lets us go deeper.”

The emphasis is on moving beyond data collection to active financial inclusion, where everyday business transactions can be translated into real access to capital, improved cash flow, and sustainable growth opportunities for SMEs.

By leveraging its growing dataset, Kayko aims to play a more direct role in shaping how credit is assessed and delivered in Rwanda’s SME ecosystem.

Investors Signal Confidence in Data-Led Financial Inclusion

The seed round attracted backing from a mix of regional and international investors, including Burrow Capital, the Luxembourg Development Agency, and Hanga Ignite by BRD and develoPPP Ventures.

Their participation reflects growing confidence in data-led approaches to financial inclusion, particularly those focused on SMEs, which form the backbone of African economies.

For investors, Kayko represents a scalable solution to a structural problem, how to responsibly extend credit to small businesses without traditional collateral or formal financial histories.

By embedding data generation into daily business operations, Kayko offers a model that aligns commercial viability with social impact.

A Broader Vision for SME Growth

Ultimately, Kayko’s ambition extends beyond software adoption. The startup is positioning itself as a foundational layer for SME growth, where compliance, transparency, and data-driven insights unlock opportunities that were previously out of reach.

By turning routine sales and expenses into trusted financial signals, Kayko is helping small businesses move from economic invisibility to financial credibility.

With fresh capital, a growing user base, and a clear focus on data as the gateway to credit, Kayko is emerging as a key player in Rwanda’s fintech landscape, and a potential blueprint for SME financial inclusion across Africa.

Talking Points

Kayko’s model reflects a thoughtful and increasingly necessary shift in African fintech, from simply digitising payments to building financial visibility for SMEs, but its long-term impact will depend on execution and ecosystem alignment.

By positioning itself as a micro-ERP and data layer, Kayko tackles the core reason small businesses struggle to access credit, the absence of reliable, continuous financial data.

However, the challenge lies not just in data collection but in ensuring lenders actually trust, integrate, and act on that data at scale.

While the traction of over 8,500 SMEs is notable, sustaining growth will require strong partnerships with banks, regulators, and tax authorities to translate insights into affordable credit rather than high-interest lending.

Additionally, Kayko must balance data monetisation with privacy and compliance obligations, especially as it deepens credit scoring.

If successfully executed, the startup could help redefine SME financing in Rwanda by shifting credit decisions from collateral-based judgments to performance-based assessments, but failure to convert data into fair and accessible financial products would limit its promise to operational efficiency rather than true financial inclusion.

_____________________

Bookmark Techparley.com for the most insightful technology news from the African continent.

Follow us on X/Twitter @Techparleynews, on Facebook at Techparley Africa, on LinkedIn at Techparley Africa, or on Instagram at Techparleynews