Ajoke Emekene, a fintech infrastructure and compliance specialist, has revealed that even industry giants like Meta have blind spots in their systems.

In a LinkedIn post on Monday, June 30, 2025, Ajoke shared a personal story that highlights the importance of robust oversight and compliance measures.

Ajoke, who has worked on growth campaigns at TikTok and scaled performance for fintech firms like Monzo, Wise, and NatWest, emphasized that no system is foolproof.

In her post, the Co-Founder of Getcleared.ai narrated her experience with Meta, where she still receives onboarding emails four years after her job offer was rescinded.

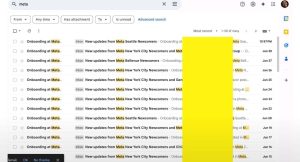

“I still get Meta onboarding emails, 4 years after my offer was rescinded,” Ajoke wrote, sharing a screenshot of her inbox.

“Every day: ‘New updates from [INSERT CITY] Newcomers!’ The job that never was. Still haunting my inbox.”

“If Meta still hasn’t removed me from an onboarding list after 4 years… What’s slipping through your compliance reviews? What’s hiding in your marketing workflows? What expensive mistake is waiting to happen?” Ajoke asked, emphasizing the need for fintech companies to prioritize compliance and marketing efficiency.

Why it matters

According to Ajoke, Meta’s broken system serves as a reminder of the potential risks and consequences of flawed processes.

“We trust processes that are fundamentally broken. We assume someone else will pick up on the issues. We hope our blind spots won’t matter. Until they do,” she noted.

Introducing Getcleared.ai

Against this backdrop and insight, Ajoke noted that she is building a platform designed to help fintech companies identify and address compliance issues, optimize their marketing workflows, and avoid costly mistakes.

She stated, “I think about this every time I see another fintech or Bank hit with compliance fines. Another company caught off-guard. Another marketing team scrambling. The ghosts in their system cost millions.

“We trust processes that are fundamentally broken. We assume someone else will pick up on the issues. That’s why I’m building GetCleared.AI Because I’ve seen what happens when broken systems meet regulatory reality. And I’m building it on Lovable.”

What we know

In another LinkedIn post, the co-founder explains that the new compliance product will help startups fix compliance issues to avert the last minutes scrambling.

“It’s the tool I wished existed during my years at Tik Tok, watching fintech teams scramble to fix compliance issues at the last minute,” she noted.

Techparley gathered that the tool is “built for UK, Canada, Nigeria, US, South Africa, Kenya markets” and gives users an opportunity to:

- Upload their creative (image or video)

- Get an instant compliance review/score

- See the regulatory and platform risks

- Fix issues before they cost them millions in fines and damaged credibility

Talking Points:

At Techparley, we consider the development of GetCleared.ai as a platform designed to help fintech companies identify and address compliance issues as a timely and necessary innovation, especially in Africa’s rapidly growing digital economy.

If not for anything, given the world’s increasing reliance on digital services, it’s imperative that fintech companies prioritize compliance and regulatory adherence to avoid costly mistakes and reputational damage.

Ajoke’s product should therefore concern everyone, from regulators to consumers, as non-compliance can have far-reaching consequences, including financial losses and erosion of trust in the digital ecosystem.

However, Ajoke’s team also needs to conduct thorough user testing and feedback sessions with fintech companies and marketers to validate the product’s features and effectiveness.

In addition, it is also important that the team collaborate with regulatory experts and industry professionals to ensure the compliance review/score feature is accurate and up-to-date with the latest regulations.

With this in check, the GetCleared product should be a major success, and a redefining point for the industry.