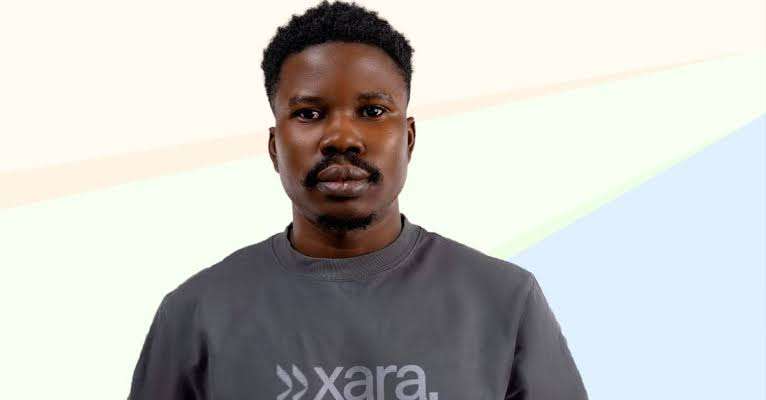

When Sulaiman Adewale’s Xara launched, it wasn’t to disrupt the fintech space or chase venture capital. It was to solve a simple, deeply personal problem: helping Nigerians complete a basic bank transfer without stress.

That moment would evolve into Xara, a multimodal, AI-powered banking assistant that runs entirely inside WhatsApp.

Designed to make everyday transactions conversational, Xara is already being hailed by many industry experts as one of the most intuitive fintech tools to emerge from West Africa.

Launched in June 2025, Xara enables users to send money, pay bills, and track expenses, entirely through WhatsApp, according to Adewale.

“I wanted an easier way that carries everybody along in banking, and if you look at it properly, you will see that WhatsApp is what even the oldest people among us use,” Adewale said in a recent interview.

A Builder with a Mission

According to Adewale, he has spent the last years building complex systems for startups across Africa. He has worked as a Senior Software Engineer at Voya App, where he led efforts in backend optimisation for financial services tools.

Prior to that, he was the Lead Software Engineer at Boost in Zambia, where he helped scale small business credit platforms across Lusaka.

Earlier, he held the role of Engineering Lead at Kiakia. During his time there, he worked on CI/CD pipelines, system architecture, and security frameworks.

His engineering foundation was solidified at PalRemit, where he worked as a Software Engineer, building Dockerised services and contributing to DevOps for cross-border remittance platforms.

Banking for the Excluded

According to Xara, it requires only a phone number, WhatsApp, and a linked payment account. Its first integration was with 9 Payment Service Bank (9PSB), which issued virtual account numbers to onboard users.

But demand quickly overwhelmed that initial setup. In its first two weeks, Xara has already onboarded 10,000 users and processed over ₦135 million ($88,200) in transactions, according to Adewale.

However, the spike in demand forced the team to temporarily halt new signups while expanding backend partnerships.

The broader mission, Adewale says, is to target Nigeria’s financially excluded people, especially those in rural communities, low-income households, and older demographics who find mobile banking inaccessible.

AI That Understands You

According to Adewale, Xara is powered by a multimodal large language model that processes not just text but also voice and visual data. It can interpret messages and respond appropriately.

According to him, Xara currently supports English and Nigerian Pidgin, with development underway to integrate Hausa and Yoruba.

“We have focused on just pidgin and English, but we are currently working on it to make it even understand our local languages like Hausa and Yoruba,” Adewale added.

Security That Thinks Like a Nigerian

As digital financial fraud becomes more sophisticated, Xara has built its protections not just for compliance, but for real-world Nigerian usage, where phones are shared, stolen, or used on public Wi-Fi.

Adewale’s team has added multiple layers of user-controlled security designed for local realities:

- Passcode for Every Payment: Every transaction through Xara is protected by a custom 4-digit PIN set during onboarding.

- Private Chat Lock for Xara: Users can hide the entire Xara chat inside a locked folder, accessible only with their phone’s biometric ID or passcode.

- Biometric Login for Extra Safety: Individual conversations with Xara can be locked with a single tap, ensuring that only the verified owner can view or send messages.

“We don’t retain those personal banking details ourselves; the only data we log is related to payment transactions, just for tracking and resolution purposes, if any issues arise,” Adewale said.

Africa’s Fintech Boom

According to Statista, Africa’s fintech market revenue is projected to reach $65 billion by 2030, with Nigeria, Kenya, South Africa, and Egypt leading growth.

Xara is not alone in this new frontier. Other notable players include Mono, Tingg, and Jumo. While these platforms offer advanced backend financial infrastructure, neobanks like Kuda, Carbon, and FairMoney dominate the app-based segment.

One Builder, a Big Vision

Adewale says future updates will include savings automation, voice commands, and integrations with e-commerce and logistics platforms, allowing users to say things like, “Order dinner” or “Send package to Onitsha”, and watch Xara do the rest.

“We are still working on integrating additional services like savings plans, utility payment, and even e-commerce and logistics, like telling it to order food for you, and it will still do,” Adewale said.

Experts say if Xara succeeds, it could reframe how financial services are delivered not just in Nigeria, but across any country where WhatsApp dominates and banking fails to reach the masses.