Nigeria has finally stepped out of the shadows of international financial scrutiny. At its October 2025 Plenary in Paris, France; the Financial Action Task Force (FATF) announced the country’s removal from the grey list of jurisdictions under increased monitoring.

This is a development analysts say could re-energise Africa’s largest economy, attract new foreign capital, and accelerate growth in its vibrant tech and financial sectors.

Tech industry leader, Tayo Oviosu, the Founder and Group CEO of Paga, believes the move will open investment opportunities for the country.

“This is a big deal because it opens up the country for FDI and enagement [SIC] from the West especially,” the CEO wrote on X while express his excitement.

Richard Montgomery, the UK High Commissioner to Nigeria, and former UK Executive Director at the World Bank, described the development as a reflection of “strong efforts to implement reforms by the Nigerian government” which is capable of opening “up new opportunities for trade and investment.”

What you should know

The FATF’s decision followed Nigeria’s full implementation of a 19-point Action Plan addressing earlier deficiencies in anti-money-laundering and counter-terror-financing frameworks.

FATF President Elisa de Anda Madrazo praised Abuja’s efforts:

“We have seen political commitment translated into measurable change on the ground … Nigeria has shown stronger capacity to investigate and prosecute, focusing resources to fight crimes that harm its communities the most.”

A Reform-Driven Journey Anchored by Wale Edun

The journey from February 2023 under the former administration, when Nigeria was first grey-listed, to its clean-bill-of-health in October 2025 was neither quick nor without some major grinds and re-tooling in the system.

It involved two critical review engagements, one in June 2025, and the decisive plenary that ended this week, and an array of legislative and institutional changes steered by Wale Edun, Minister of Finance and Co-ordinating Minister of the Economy.

Edun, now widely credited as the principal architect of Nigeria’s financial-integrity turnaround, told delegates in Paris that the reforms went beyond box-ticking.

“Our focus has been on driving reforms, enacting legislative enhancements and strengthening institutions to ensure Nigeria effectively counters money laundering and terrorist financing. The Action Plan was not the ceiling but the floor of our aspirations.”

Techparley Africa research team reviewed major economic indexes, and found out that under Edun’s watch as a minister, Nigeria:

- Modernised its AML/CFT laws, passing the Money Laundering (Prevention and Prohibition) Act 2022 and Terrorism (Prevention and Prohibition) Act 2022;

- Introduced a Beneficial Ownership Register, compelling companies to disclose true owners and curb anonymous shell entities;

- Expanded supervision of Designated Non-Financial Businesses and Professions (DNFBPs) such as lawyers, real-estate firms and casinos;

- Integrated financial-intelligence databases across security and fiscal agencies; and

- Improved cross-border cooperation with regional and global partners through GIABA and Interpol channels.

Economists say these steps now place Nigeria closer to global AML/CFT standards and enhance its credibility before lenders and investors.

Edun’s broader fiscal reforms, ranging from harmonizing exchange-rate policies to rationalizing fuel-subsidy savings into infrastructure investment, have reinforced perceptions of Nigeria as a country determined to rebuild confidence through discipline.

NFIU: The Engine Room of Reform

Behind the scenes, the Nigerian Financial Intelligence Unit (NFIU) executed much of the heavy lifting. Director/CEO Hafsat Abubakar Bakari, known for her data-driven leadership, coordinated the multi-agency task force that delivered the reforms on schedule.

“Nigeria’s removal from the FATF grey list is a true test of our resilience, coordination and unwavering commitment to reform,” Bakari said.

“It signals to the world that Nigeria can meet and exceed global standards in financial integrity.”

In comparing the state of the nation to what it used to be before the Tinubu-led administration, Techparley discovered that under Bakari’s stewardship, the NFIU:

- Digitised financial-intelligence collection and analysis tools, enabling faster detection of suspicious transactions;

- Worked closely with banks and fintechs to improve Know-Your-Customer (KYC) compliance;

- Built capacity for prosecutors handling complex money-laundering cases; and

- Introduced real-time collaboration protocols between security agencies.

Today, the NFIU’s model of partnership between government and private-sector actors is now viewed as a template for other West African states. FATF President Madrazo cited these institutional gains as decisive factors in Nigeria’s delisting.

Justice and Interior: Legal Backbone and Security Coordination

The Attorney-General of the Federation, Prince Lateef Fagbemi (SAN), chaired the Inter-Ministerial Committee on AML/CFT/Proliferation Financing, ensuring that the required laws passed constitutional scrutiny and judicial interpretation.

His ministry established specialized financial-crime courts to fast-track prosecutions, a move praised by FATF reviewers.

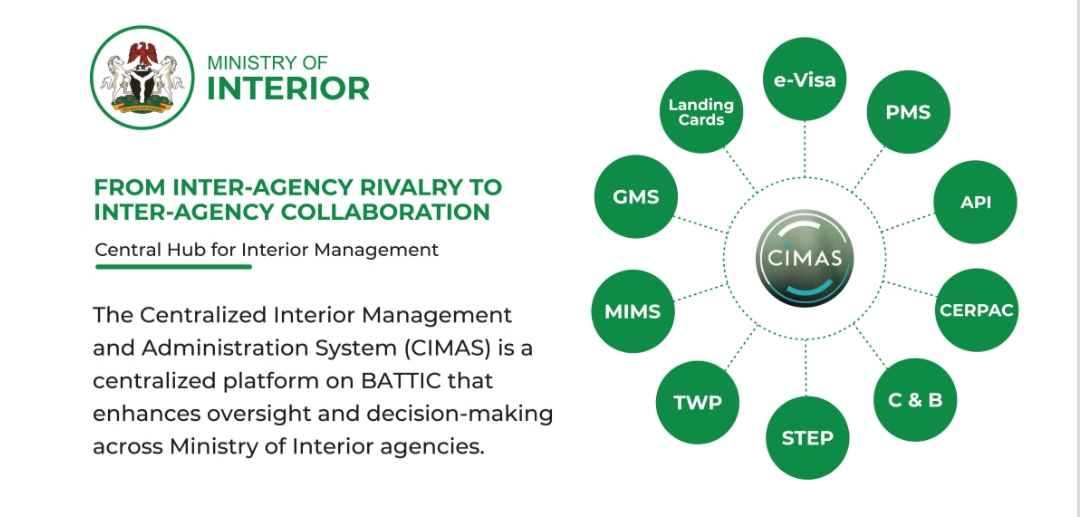

Simultaneously, Interior Minister Olubunmi Ojo through his Centralized Interior Management and Administration System (CIMAS) streamlined intelligence exchange among immigration, civil defense and other internal-security agencies to choke terrorist-financing channels.

This high-level coordination created the operational backbone that complemented Edun’s economic reforms and Bakari’s technical enforcement.

Why the Exit Matters for Nigeria’s Economy

Leaving the grey list has profound economic meaning. International banks often restrict or delay transactions involving grey-listed countries, raising costs for exporters, importers and fintech platforms.

With the stigma removed, cross-border payments and correspondent-banking relationships are expected to normalize.

For Nigeria’s expanding fintech ecosystem, home to global players such as Flutterwave, Paystack and Moniepoint among others, the delisting is a reputational lift.

Fewer compliance hurdles mean faster integration with foreign partners, easier access to payment-gateway licences, and renewed investor appetite.

Economists also anticipate a surge in Foreign Direct Investment (FDI) as risk perceptions decline. Improved transparency in beneficial-ownership data reassures foreign investors wary of opaque corporate structures.

Coupled with Edun’s macro-stability drive, analysts expect capital inflows to strengthen the naira, deepen reserves, and spur job creation across manufacturing, financial services and digital industries.

Experts believe that the Grey-list removal is more than symbolic as it lowers the compliance premium on Nigerian assets, enabling firms to borrow abroad at cheaper rates and expand employment at home.

Sustaining the Momentum

President Bola Ahmed Tinubu, in his reaction, hailed the FATF decision “as a major milestone in Nigeria’s journey towards economic reform, institutional integrity and global credibility.”

Tinubu credited Edun, Fagbemi, Tunji-Ojo and Bakari for steering the country through complex reforms, while acknowledging the support of other ministers, including Aviation, Budget and Economic Planning, Defence, Foreign Affairs, Solid Minerals and State for Finance, as well as the Secretary to the Government of the Federation, the National Assembly, and the Judiciary.

Tinubu emphasised that compliance is only the starting point.

Our commitment goes beyond meeting benchmarks. It reflects a national transformation agenda rooted in transparency, integrity and accountability.”

Continental and Global Context

Nigeria’s removal coincided with the delisting of Mozambique, Burkina Faso and South Africa, marking an encouraging moment for African financial-sector governance.

FATF’s invitation for Nigeria to join its Great Jurisdictions Initiative for one year, allowing NFIU experts to contribute directly to global AML/CFT policy, is widely seen as a badge of trust.

This engagement gives Nigeria a platform to shape debates on emerging threats, including AI-driven financial crime, deepfakes, and cryptocurrency regulation, aligning perfectly with the country’s ambitions to build a robust digital-economy policy.

From Compliance to Prosperity

For Edun, the real test begins now. “Our task is consolidation,” he said in Paris.

We will maintain high standards, deepen reforms, and leverage renewed trust to strengthen the foundations for rapid, inclusive, and sustainable growth.”

Nigeria’s clean bill from FATF is expected to ripple through its economy:

- Capital inflows are likely to rise as international investors regain confidence;

- Fintech exports and remittance channels could expand, bringing in fresh foreign currency;

- Manufacturing and service-sector employment may increase as FDI-funded projects resume; and

- Reg-tech and compliance-tech industries stand to benefit from ongoing demand for monitoring and verification tools.

Talking Points

Nigeria’s removal from the FATF grey list marks a significant regulatory milestone with broad implications for its financial system and economic outlook.

The decision follows extensive reforms aimed at improving the country’s anti-money laundering and counter-terrorism financing framework, coordinated by the Federal Ministry of Finance under Wale Edun and implemented through the Nigerian Financial Intelligence Unit (NFIU).

The process also involved the Attorney General of the Federation and the Minister of Interior, demonstrating a whole-of-government approach to compliance.

While the delisting indicates that Nigeria has addressed key strategic deficiencies identified by the FATF, its long-term impact will depend on how effectively these reforms are maintained and enforced.

It is agreeable that the move could enhance Nigeria’s access to international financial systems, potentially improving capital flows, foreign investment, and cross-border transactions.

However, sustaining confidence will require consistent oversight, institutional transparency, and continued collaboration between regulators and the private sector to prevent a relapse into systemic financial vulnerabilities.

_______________________

Bookmark Techparley.com for the most insightful technology news from the African continent.

Follow us on X/Twitter @Techparleynews, on Facebook at Techparley Africa, on LinkedIn at Techparley Africa, or on Instagram at Techparleynews