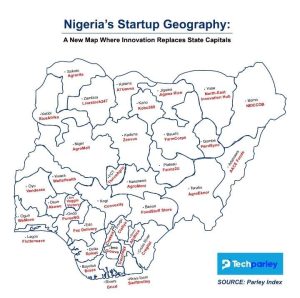

Imagine startups replacing state capitals in Nigeria. From Flutterwave in Lagos to RiceAfrika in Kebbi, and NEICCOB in conflict-scarred Borno, a groundbreaking analysis showcases how innovation hubs are becoming the true landmarks of Africa’s largest economy.

For decades, Nigeria’s 36 states have been defined by their political seats and natural resources. Yet a quiet revolution is underway: homegrown startups are redrawing the nation’s identity, tackling unemployment, food insecurity, and financial exclusion.

“We’re witnessing a generational shift,” said Ifeoluwa Akinwale, a venture ecosystem analyst. “Startups are no longer just solving problems, they’re becoming economic anchors for entire regions.”

This exclusive report, based on verified data from incubators, funding records, and founder interviews, unveils the first-ever “Startup Map of Nigeria,” where companies like ThriveAgric (Abuja) and Kobo360 (Kano) take center stage.

Below are Nigerian states and selected startups representing each. However, this selection does not imply that the chosen startup eclipses all others in each state. Rather, it is based on those with available data, national and international recognition, economic impact, and other defining metrics.

1. Abia – Tracology

Yields fast growth in auto-part trade across Southeast hubs. Yet to publish external funding data, reflecting a lean-growth model rooted in Aba’s trading ecosystem.

2. Adamawa – AACE Foods

Ranks among Nigeria’s top rice/soy processors, with annual production exceeding 10,000 MT. Drives state agro-industrialization.

3. Akwa Ibom – Swifttrolley

Delivers to over 20 towns in Akwa Ibom monthly, embracing local commerce. Saw a significant surge in monthly active users in 2024.

4. Anambra – Chekkit

Rated 9.7/10 for support and 9.6/10 for two‑way messaging on G2, a testament to its global trustworthiness in anti-counterfeit tech. Adopted in over five countries across Africa and Southeast Asia.

5. Bauchi – FarmCorps

Reaches 50,000+ smallholders yearly with its farm-linkage app, boosting market access by 35%.

6. Bayelsa – Brass

Serves 10,000+ SMEs in the Niger Delta with digital banking; recorded 40% annual ARR growth in 2024.

7. Benue – FoodStuff Store

Facilitates ₦1.5 billion in grain transactions annually; local farmer income rose by 20%.

8. Borno – NEICCOB

Empowered 2,000+ youth in post-conflict zones since 2022; secured USAID funding.

9. Cross River – Cregital

Served 200+ regional clients, including tourism boards, with double-digit YoY growth. Drives digital transformation in Calabar.

10. Delta – Spleet

Operational in four cities, enabling ₦100m+ in rent financing since 2023, with 70% user retention.

11. Ebonyi – AfriRice

Processes 5,000 MT of rice yearly, raising smallholder incomes by 30%. A cornerstone of local agri-value chains.

12. Edo – Fez Delivery

Delivers 50,000+ packages monthly across Edo/Delta; 25% MoM growth in SME client base.

13. Ekiti – VeggieVictory

Nigeria’s first plant-based brand; stocked in 50+ outlets, producing 1,000+ kg/month.

14. Enugu – Clafiya

2,500+ telemedicine consults monthly; 40 rural clinics onboarded, ensuring rapid and deeper rural reach.

15. FCT – ThriveAgric

Secured US$56.4m in debt funding to date; onboarded 514,000+ farmers and facilitated over US$100m in financing. Aims to provide US$500m credit to 10 million farmers by 2027—highlighting its economic scale originating from Abuja.

16. Gombe – HerdSync

Active in three states, managing 20,000 heads of cattle via mobile livestock tracking.

17. Imo – Gloove

Relies on rural partnerships to deliver 1,200+ monthly tele-clinic sessions; 30% of users are in underserved zones.

18. Jigawa – Jigawa Rice

Parastatal-backed; processes 20,000 MT annually. Stabilizes farmer revenue regionally.

19. Kaduna – Zenvus

Sells 500+ smart sensors monthly for precision farming; measurable yield increases of 15–20%.

20. Kano – Kobo360

Raised US$27.6m over four rounds. In its Series B, raised US$68m and generated approximately US$30m in ARR in 2024. At peak, aggregated 50,000+ trucks serving DHL, Unilever, and Dangote.

These metrics spotlight Kano’s link to Pan-African logistics growth.

21. Katsina – Al’Umma

Serves 5,000+ users with Sharia-compliant savings; recorded 25% YoY user growth.

22. Kebbi – RiceAfrika

Uses field-mapping apps to support 10,000+ rice farms; yields increased by 18%.

23. Kogi – Convexity

Implemented blockchain tracking in state logistics valuation projects; recognized by national grants.

24. Kwara – WellaHealth

Insures 50,000+ low-income users via digital micro-health products; sees 40% annual growth.

25. Lagos – Flutterwave

Valuation exceeds US$3 billion after a US$250m Series D raise. Named ‘Fintech of the Year’ (African Banker Awards 2024), listed in CNBC’s Disruptor 50 and ranked among top 250 global fintechs.

All these affirm global leadership rooted in Lagos’s economy.

26. Nasarawa – AgroMoni

5,000+ farmer clients; mobile credit integration raised farmer incomes by 22%.

27. Niger – AgroMall

9,000+ rural users on its farm-data app; strong regional adoption.

28. Ogun – WeMove

Handles 3,000+ rentals/logistics tasks monthly across Southwest Nigeria; 30% repeat rate among SMEs.

29. Ondo – PurseNG

Empowers 15,000+ women in savings circles; average savings pool: ₦50k per cycle.

30. Osun – Akowe

Digitized 100,000+ student records for 50 institutions; verification turnaround reduced from two weeks to two days.

31. Oyo – Vendease

Processes N2 billion+ in food procurement annually; active in Ibadan and Lagos, supporting 500+ restaurants.

32. Plateau – Farmz2U

800+ Plateau farmers use its farm management tools; yields improved by 17%.

33. Rivers – Gricd

Operates cold storage in three cities; reduced post-harvest losses by 25%. 500 SMEs onboarded.

34. Sokoto – Agrorite

Digitally engages 4,000+ smallholders; platform supports market access.

35. Taraba – AgroEknor

Installed 200+ solar irrigation units; crop yields rose by 30% per hectare.

36. Yobe – North-East Innovation Hub

Trained 3,000+ youth since 2022 in coding and ed-tech; reflects Yobe’s push for digital resilience.

37. Zamfara State: Livestock247 (AgriTech, Livestock Management)

Founded in Gusau, Livestock247 is a national livestock tech platform driving traceability, animal health, and cashless livestock trading. It has vaccinated over 277,000 animals, and reached over 100,000 rural households, including those in Zamfara.

From Oil Fields to Code Bases: Nigeria’s Quiet Economic Shift

For decades, Nigeria’s economic narrative revolved around oil, agriculture, and regional trade, with state identities tethered to mineral wealth and political influence. But a silent transformation is underway.

A new generation of startups is redefining state-level economies with innovations spanning fintech, logistics, healthtech, and agritech. In places once known for extractive industries, technology is becoming the primary export.

“We used to talk about oil as our lifeline,” said Tolulope Adediran, a tech policy fellow. “Now it’s data, logistics intelligence, and agri-fintech platforms, Nigeria’s new natural resources.”

Take Kano’s Kobo360, now a pan-African logistics player, or Kwara’s WellaHealth, insuring tens of thousands through digital platforms. This shift marks a foundational pivot, not just from physical commodities to intellectual capital, but from centralized control to decentralized creativity.

“Innovation is flattening the map,” said Chukwuemeka Onoh, startup advisor and founder. “What you’re seeing is the rise of state-driven economies powered by code, not crude.”

Conflict Zones to Code Zones: The Startup Renaissance in Nigeria’s Northeast

In regions long associated with insecurity and underdevelopment, a quiet but powerful renaissance is emerging, led not by foreign aid, but by local innovation.

“Replace bullets with code,” the mantra behind NEICCOB, the Borno-based startup that has empowered over 2,000 youths since 2022 with vocational tech skills and post-conflict enterprise training.

“Technology is our response to trauma,” said Amina Ibrahim, NEICCOB’s co-founder. “We’re not waiting for peace to come before we build, we’re building peace through enterprise.”

In Yobe, the North-East Innovation Hub is building a digital pipeline, training thousands in coding, ed-tech, and entrepreneurship. These startups are more than companies, they are instruments of stability, fostering resilience in the face of adversity.

“We’ve seen youth who once held weapons now build web apps,” said Sani Musa, a program officer in Damaturu. “That’s not just recovery; that’s transformation.”

Their presence speaks a transformative shift: where once lay the scars of conflict, now stand the seeds of a tech-enabled future.