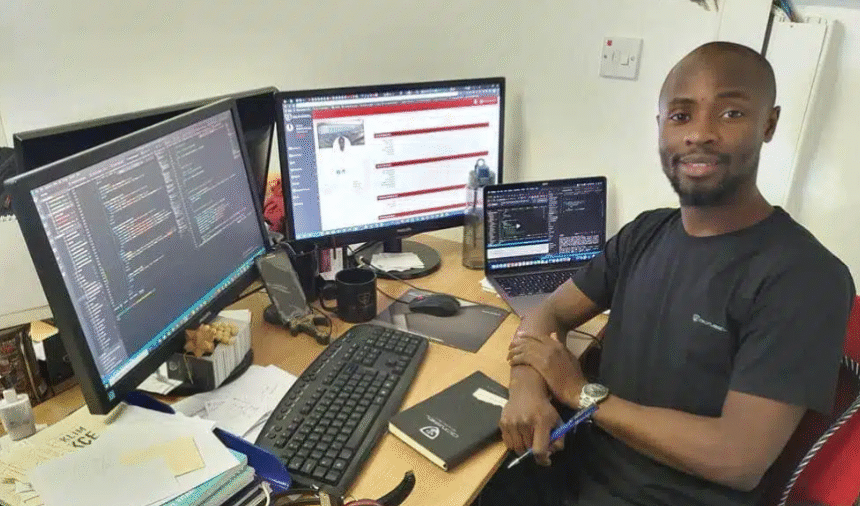

Fintech headlines often spotlight founders’ visions and funding milestones. But behind Raenest Exchange—a platform helping African freelancers and businesses access global payments—is a story rooted in both personal experience and technical competence, led by its co-founder and CTO, Sodruldeen Mustapha.

Sodruldeen holds a Master’s degree in Software Engineering from Near East University (NEU) in Cyprus, completed between 2017 and 2019. Earlier, he studied Information Technology, earning his bachelor’s degree from Kebbi State University of Science and Technology. This educational foundation laid the groundwork for a technologist able to bridge complex problems and real-world solutions.

His background isn’t theoretical. At NEU, Mustapha would have immersed himself in systems architecture, engineering methodologies, and software scalability—skills that would become critical when he co-launched a fintech startup back in Nigeria.

From Engineering to Entrepreneurship

Mustapha has spent more than a decade in software development, consultancy, and scaling systems. His resume includes building ERP systems for emerging industries—including an electric vehicle company in the Mediterranean—and consulting for UN migration projects.

By 2021–2022, he and two co-founders—Victor Alade and Richard Oyome—set out to tackle a distinct challenge in Africa’s freelance payments space. Launched initially in 2022, Raenest began as an Employer of Record (EOR) but swiftly pivoted into a broader fintech platform. The team recognized that, for many Africans, the bigger pain point wasn’t being paid—it was being paid efficiently, affordably, and reliably.

Under Mustapha’s leadership, Raenest was built to solve a simple, stubborn problem: make international payments—including currency conversion and withdrawal—frictionless for African freelancers and businesses. The platform allows users to open virtual multicurrency accounts, access debit cards in USD, EUR, or GBP, and receive global payments with fewer fees.

These features aren’t flashy—they’re functional, aimed at people whose day-to-day income hinges on those seemingly small efficiencies. Raenest now serves over 700,000 individual users and more than 300 businesses, having processed over $1 billion in payments so far.

A Fintech with Teeth

In early 2025, Raenest raised $11 million in Series A funding, bringing its total capital to approximately $14.3 million. The round was led by QED Investors, with support from Norrsken22, Ventures Platform, P1 Ventures, and Seedstars. This capital is earmarked for deepening operations in Nigeria and Kenya, as well as expansion into the U.S. and Egypt. Raenest also holds licenses as an International Money Transfer Operator (IMTO) in Nigeria and a Money Services Business (MSB) in Canada, with more approvals in the pipeline.

Mustapha, as CTO, now must navigate not just product and engineering, but regulatory complexity across borders—a different kind of software problem, one rooted in policy and legal friction.

It’s tempting to frame Mustapha as a rising fintech star. But his journey is less about heroism and more about steady, pragmatic execution. He’s not issuing grand slogans—he’s building the plumbing that connects Africa’s freelancers to global opportunity.

That said, challenges remain. A growing platform like Raenest is still accessible mainly to the tech-connected middle class, leaving behind the many who lack internet access, banking connections, or foreign currency exposure. Scaling inclusively remains the next frontier.

Why This Matters for Africa’s Digital Economy

- Homegrown solutions matter. Raenest is Finnish; its software closely reflects African user realities, from regulatory quirks to payment patterns.

- Tech leadership on the ground. Mustapha’s blend of global training and local understanding underlines that Africa doesn’t need imported leadership—it needs more technologists like him.

- The balance of expansion. Growth into markets like Egypt and the U.S. can bring scale—but the company must resist diluting the focus that grounded its early impact in Nigeria.

At core, Mustapha’s journey with Raenest reflects a repeatable pattern: African technologists educated globally returning not to build empires, but to fix everyday dysfunction. With continued funding, careful regulation, and inclusive expansion, Raenest could become a backbone for Africa’s digital workforce.

But even with success, the broader goal remains unfulfilled: building a digital economy that works not only for the connected few—but for the many.

Why it Matters

Mustapha’s vision extends beyond Nigeria. Expansion into other African markets, integration of blockchain rails for faster settlements, and partnerships with banks and governments are all on the horizon.

For Africa’s young digital workforce, the success of Raenest could mean more than convenience. It could mark a turning point where access to global earnings is no longer defined by barriers, but by opportunities.

As Mustapha himself has often argued, Africa does not lack talent—it lacks infrastructure. Raenest Exchange, if successful, may well prove to be one of the missing links in connecting that talent to the global economy.

Talking Points

For decades, African governments chased oil, gas, and minerals, ignoring the continent’s biggest resource: its young, digital-savvy workforce. Platforms like Raenest prove that the real 21st-century wealth is not underground but online. Yet, policymakers remain obsessed with crude barrels while freelancers struggle to withdraw $200 from abroad.

Raenest is not just a financial platform—it is a quiet rebellion against broken banking systems and suffocating currency regimes. Every time a Nigerian freelancer bypasses traditional banks to get paid through Raenest, it is a vote of no confidence in the financial establishment. Should we be celebrating fintech innovation or asking why governments created the need for such workarounds in the first place?

While Raenest offers solutions, it also exposes a deeper issue: Africa’s digital economy is still at the mercy of foreign currencies. Workers earn in dollars and pounds, convert to naira or cedi, and remain tied to economies outside their own. Until Africa creates digital currencies or stronger local economies, fintechs may ease the pain but cannot cure the disease.